|

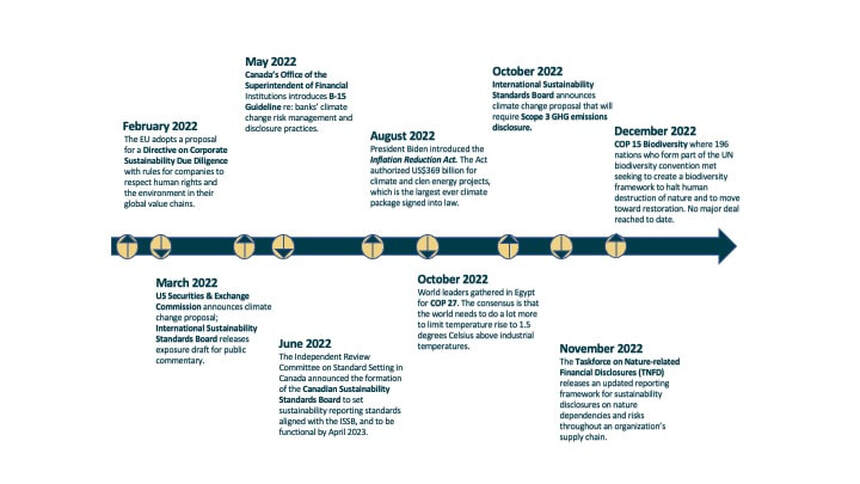

ESG in 2022 and 2023: Where are we and where can we expect to go? Peter Forrester December 20, 2022 You can’t know where you’re going unless you know where you’re at The world of sustainability and environmental, social, and governance (“ESG”) was jammed-packed in 2022 and looks to be even more crowded in 2023. So given it is the time of the year for yearly reviews and looks ahead, here’s our take on 2022’s major developments and 2023’s major expectations. Well, that was a busy year They say a picture is worth a thousand words. OK: Are we seeing some major themes here?

The first theme is we continue to move toward mandatory regulation of ESG and climate-related reporting and disclosure. In North America alone, the US Securities and Exchange Commission, Canadian Securities Administrators, Office of the Superintendent of Financial Institutions have all released draft disclosures. Keeping abreast of regulatory requirements will be critical for reporting in 2023. The second theme is a continued convergence of sustainability reporting frameworks aligned with investors’ needs. Most frameworks are aligning with the Task Force on Climate Related Financial Disclosures (“TCFD”). Not only are frameworks becoming more aligned with TCFD, but disclosure frameworks will increasingly demand climate risk reporting that is consistent, credible, comparable, and transparent and that demonstrates the impacts on long-term corporate value. The release of the International Sustainability Standards Board (“ISSB”) sustainability disclosure draft this year means we can expect significant reporting changes as soon as 2023. The third major theme is increasing the clampdown by regulators on “greenwashing.” We have seen regulators investigating and fining companies for making misleading of false claims regarding their sustainability performance or attributes of their products and services. Perhaps the most recent example in Canada is the investigation launched by the Canadian Competition Bureau last month against the Canadian Gas Association. In that case, the complainants allege that claims that natural gas is a low-emissions source of energy equate to deceptive marketing practices. We are also seeing increasing related litigation worldwide, which will continue to be a theme in 2023. The fourth theme is an increasing attention to the consideration of nature and biodiversity in addressing climate change risks and opportunities. This was a consistent theme at both COP 27 and COP 15 in the context of the economy being heavily dependent on the assets and services that nature provides. Yet, even as climate change risks point to the reliance on nature and the resilience of businesses and their supply chains, the translation of this relationship into risks to long-term corporate value are under-considered (or simply not considered) in sustainability reporting. This is changing as we can see from the development of the Taskforce on Nature Related Financial Disclosures (“TNFD”), which released a new risk management and disclosure framework in November this year. Additionally, this month the Global Reporting Initiative (“GRI”) announced a new draft biodiversity reporting standard in an attempt to bring about global standardized reporting in this area. These developments will have a significant impact on sustainability reporting in 2023. How will this impact your business in 2023? Investors, regulators, consumer, employees and stakeholder demands for understanding how businesses are addressing the risks posed by climate change will continue to grow. This demand is increasingly being taking shape in converging regulations and frameworks that can translate non-financial ESG factors into financial outcomes to provide insight into how business will fare through the inevitable climate change impacts that are already upon us. Successful companies have always considered their business risks and opportunities and translated these into strategies to mitigate the risks and maximize the opportunities. Companies in high-emitting and resource-intensive industries have been required to continue to develop their sustainability strategies, assessments, and reporting. Additional requirements, such as impending Scope 3 reporting, will continue to provide reporting challenges and opportunities. But additionally, sustainability reporting will become increasingly important to all companies, public or private, small or large, as the momentum and appetite to understand a broad range of ESG factors increases. The best thing you can do in 2023 is determine where you are on the sustainability reporting spectrum. Those companies that haven’t started the journey are well advised to do a basic sustainability materiality assessment of their businesses. Those companies that are well on their way, can benefit from increased proactive considerations of the themes above. And the leaders will continue to inform consolidating regulations and frameworks, science-based targets, a better understanding of their supply chains and Scope 3 emissions, and sustainability reports that are fully integrated into their public disclosures. 2023 looks to be a busy year on the sustainability front. Until then, best wishes for the holiday season and we look forward to chatting in 2023! Sustrio ESG Advisors is a trusted advisor that helps organizations identify climate related-risks and opportunities to enhance corporate value through the energy transition. That means addressing changing regulatory regimes, investor demands, and stakeholder and Indigenous concerns. We do this by providing a full suite of sustainability/ESG services, Indigenous relations and engagement services, permitting and regulatory services, and legal services. Connect with us to see how we can help your company navigate the energy transition, optimize your ESG strategy and programming, and report on all your ESG matters.

0 Comments

The Sustainability-Indigenous Nexus: does your sustainability strategy consider it?

Peter Forrester December 13, 2022 Introduction Sustainability is, and will continue to be, viewed increasingly through an investor’s quantitative lens. Increasingly, businesses are being required to measure and disclose their sustainability performance. They are required to show, through data that are complete, credible, consistent, and comparable, that they are analyzing and improving the environmental, social, and governance elements of their business. Specifically, they must demonstrate that they have addressed the risks of climate change, including both physical risks to their assets and energy transition risks as we move to a lower carbon economy. Sometimes, however, Indigenous issues can be overlooked or lost in the noise and clamor of sustainability discussions and reporting. What do sustainability and environmental, social, and governance (“ESG”) metrics have to do with Indigenous issues? In short, “a lot.” The environment we share Canada is arguably endowed with a unique competitive advantage when it comes to the environment – we are gifted with vast tracts of undeveloped land ripe with oil, gas, forests, minerals, metals, biodiversity, and agriculture, with pristine lakes, rivers, and oceans, not to mention great feedstock for renewables, including solar, wind, hydro, and nuclear. When it comes to the land, water, and air and the resources they contain, we share them as non-Indigenous and Indigenous people alike. Indigenous peoples have been living on and from the land for thousands of years, hunting, trapping, fishing, and harvesting. They are keenly aware of the effects climate change brings to the environment as it impacts their ability to continue their traditional ways of life. They are equally aware of the energy transition, and how energy development impacts their traditional ways of life and well-being. Indigenous communities maintain their own Indigenous Knowledge, which they pass down from generation to generation. At the heart of that knowledge is a worldview that the universe, its people, and the environment are interconnected. Sustainability is viewed from a reciprocity concept between people and the planet. Indigenous peoples have a deep respect for nature and its conservation as well as a community-based management approach to lands and natural resources: “Traditional Knowledge has today become a highly valued source of information for archaeologists, ecologists, biologists, ethnobotanists, climatologists and others. This information ranges from medicinal properties of plants and insights into the value of biological diversity to caribou migration patterns and the effects of intentional burning of the landscape to manage particular resources. For example, some climatology studies have incorporated Qaujimajatuqangit (Inuit traditional knowledge) to explain changes in sea ice conditions observed over many generations.” (George Nicholas, “How Western science is finally catching up to Indigenous knowledge,” Macleans, February 15, 2018, link). This Indigenous knowledge is increasingly being combined with Western science in both understanding and addressing climate change as well as in project development. A recent example of Indigenous-led initiatives to address climate change Last week, the 15th Conference of the Parties (“COP 15”) to the United Nations Convention of Biological Diversity kicked off in Montreal. The meeting focuses countries’ attention on protecting the environment and halting biodiversity loss caused by climate change. Given that lands inhabited by Indigenous peoples contain 80% of the world’s remaining biodiversity, their inclusion is critical, according to the International Institute for Sustainable Development (link). This is even more apparent when we consider that Canada is warming twice as fast as the rest of the planet, and three times as fast in its most northern regions where many Indigenous people reside and depend on the land and water for their livelihood (see Isabella O’Malley, “Canada is warming twice as fast as the rest of the world,” The Weather Network, 2019, link). As the conference kicked off, the Liberal government highlighted the “Sustainability-Indigenous Nexus by announcing that it will spend up to $800 million to support four major Indigenous-led conservation projects covering nearly one million square kilometers across the country. The projects include:

These projects were announced during the kick off last week of the COP 15 UN Biodiversity Conference being held in Montreal. Resource project development In Canada, if project development impacts the rights, title, interests, and rights of Indigenous communities, the Crown (federal and provincial governments) have a legal obligation to consult, and if necessary, accommodate Indigenous communities for impacts. From a resource project development perspective, this “Crown consultation and engagement” has largely been addressed through the formal mechanisms of multiple energy and resource regulators. While that continues to occur, we are also seeing more proactive and creative ways for Indigenous communities’ involvement in such projects. A recent example is the landmark Enbridge Indigenous partnership in the Athabasca region of Alberta. In that deal, 23 Indigenous communities via the Athabasca Indigenous Investments entity acquired an 11.57 percent interest in seven Enbridge-operated pipelines. The investment is valued at $1.12 billion. Such investment allows Indigenous communities to have direct input into how resource projects are developed, operated, and expanded. They also have the added benefit of providing economic and social benefits to the communities involved. There are, and will continue to be, many more such joint resource projects. From an investor’s perspective, these joint projects have multiple benefits. Firstly, they de-risk projects by ensuring that the Indigenous environmental and other concerns are considered at the outset of the project, thus reducing execution risk. Secondly, they provide a source of opportunities available to benefit from sustainable resource projects and to build and enhance long-term corporate value for project developers. Social impact and Indigenous reconciliation In 2015, the Truth and Reconciliation Commissions’ final report set out a call to action for Canadian businesses. The report called on the corporate sector to apply a reconciliation framework to its corporate policies and operational activities involving Indigenous peoples, lands, and resources. It made 92 recommendations, with three concepts at the heart of those recommendations:

Businesses have a great opportunity to work with Indigenous communities on and around their operations to incorporate Indigenous knowledge into environmental approaches, as well as improving engagement in relation to the “S” in ESG. However, as reported in PwC’s … “Fewer than one in five (19%) of the companies on our analysis discloses a reconciliation action plan.” Those companies, particularly in the extractive industries can utilize their materiality assessments and sustainability reporting to demonstrate they are doing more on the reconciliation front. Conclusion Sustainability in Canada is intricately linked with Indigenous consultation and engagement. Tackling climate change and the transition to a low carbon economy present monumental risks and opportunities for Canadian businesses. Those risks are diminished, and the opportunities maximized, when non-Indigenous and Indigenous people work together toward a common goal. Indigenous peoples describe that goal broadly as “if we take care of the land, it will take care of us.” Investors might describe that goal as transparent, credible, consistent, comparable quantitative metrics illustrating improved ESG performance that will allow businesses to be sustainable in the long run. Regardless of what you call it, the result of working together for a more prosperous sustainable Canadian economy that maximizes the benefits and reduces the risks for all only occurs if we understand and respect the Sustainability-Indigenous Nexus. Sustrio ESG Advisors is a trusted advisor that helps organizations identify climate related-risks and opportunities to enhance corporate value through the energy transition. That means addressing changing regulatory regimes, investor demands, and stakeholder and Indigenous concerns. We do this by providing a full suite of sustainability/ESG services, Indigenous relations and engagement services, permitting and regulatory services, and legal services. Connect with us to see how we can help your company navigate the energy transition, optimize your ESG strategy and programming, and report on all your ESG matters. Click here Get ready for the ISSB in 2023: Where sustainability reporting is going?

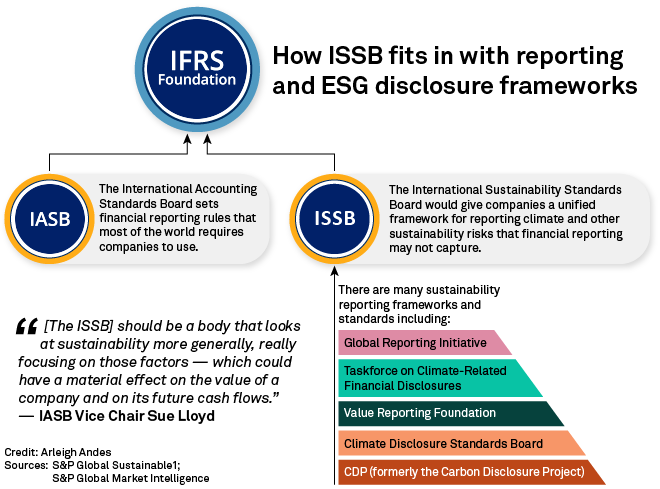

Peter Forrester December 6, 2022 Where are we are today on sustainability reporting? Canadian companies are in a global competition to attract capital and to grow market share. Increasingly, the ability to do so is dependent on how investors view a company’s performance on “non-financial factors” such as environmental, social, and governance (“ESG”) factors. Investors want to understand how performance in these areas impacts financial performance over the short-, medium- and long-term. Unfortunately, they are beholden to sustainability reporting, which is currently guided by a set of diverse, inconsistent, and often conflicting standards, frameworks, and ratings that do not offer comparability and consistency in sustainability reporting in general, and this has implications for financial performance in particular. But all of this is changing. Where in the world are we going? In short, international sustainability reporting standards tied to financial reporting are on the way. In November of 2021, the International Financial Reporting Standards (“IFRS”) Foundation, which is responsible for setting global financial reporting standards, created the International Sustainability Standards Board (“ISSB”). The ISSB was created in response to demands from the G20 countries and investors for the creation of global sustainability reporting standards that are tied to financial reporting, and can be relied upon as being comparable, credible, and consistent. Most importantly, the standards are such that investors and capital market participants can make capital allocation decisions based on how a company is addressing climate and energy transition risks and opportunities. To streamline things even more, shortly after the creation of the ISSB, the IFRS Foundation Trustees announced the planned consolidation of the IFRS Foundation, the Climate Disclosure Standards Board (“CDSB”), and the Value Reporting Foundation (“VRF,” formerly, the Sustainability Accounting Standards Board). The CDSB consolidation was completed in January 2022; the VRF consolidation in August 2022. In addition, in March 2022 ISSB and the Global Reporting Initiative (“GRI”) announced an MOU, committing both organizations to coordinate work programmes and standard-setting activities. The ISSB also released two draft sustainability standards this year, which went out for public consultation, and will likely be finalized in 2023. The first draft standard is the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information. S1 sets out the standard on what sustainability-related financial information about an entity’s significant sustainability-related risks and opportunities should disclose using the four thematic areas established by the Task Force on Climate-related Financial Disclosures (“TCFD”) framework. Essentially, it requires disclosures around TCFD’s four pillars of governance, strategy, risk management, and metrics and targets. Importantly, there are clear standards and guidance on concepts of what is material, enterprise value, disclosures related to dependencies on people and planet, and the requirement that such disclosures be made at the same time as a company’s general financial reporting. The second draft standard is the IFRS S2 Climate-related Disclosures. S2 builds on the TCFD recommendations and sets the requirements to be used in reporting on the identification, measurement, and disclosing of climate-related risks and opportunities. As with S1, it is also aligned with TCFD, including its call for the use of climate-related scenarios in risk planning and reporting. Given the wide adoption of IFRS standards and given that the standards are agnostic as to what accounting system a country uses (e.g., the U.S. uses Generally Accepted Accounting Standards (“GAAP”), not IFRS), it can be expected that countries around the world will move quickly to adopt the ISSB standards. How will Canada get there? In Canada, Financial Reporting Assurance Standards (“FRAS”) is tasked with setting and maintaining accounting and auditing standards in the public interest. In alignment with ISSB, FRAS announced the formation of the Canadian Sustainability Standards Board (“CSSB”). The CSSB, which will be fully functional by April 2023, is tasked with working with the ISSB to ensure Canadian views on sustainability standards are part of the ISSB’s work, as well as reviewing, endorsing, and implementing ISSB standards in Canada. In short, Canadian companies can expect that sustainability disclosures standards aligned with ISSB and CSSB are coming soon. This means more rigorous disclosures will be required and additional work will have to be done to translate how ESG factors will impact a corporation’s corporate value and financial outlook going forward. How to get ready for 2023 Many Canadian companies have identified their organizations’ ESG risks and opportunities and have started to develop baseline emissions inventories and strategies for how to address transition and physical climate-related risks and opportunities. But many are still behind in their ESG maturity and need to catch up quickly. To prepare for 2023 and the coming ISSB and CSSB standards, companies (particularly publicly-traded companies) should review the ISSB draft documents now. They should consider doing a gap analysis of where their sustainability reporting is today, and where it will need to be under the new standards. In particular, they should focus their efforts on long lead time items (things that cannot be implemented overnight) such as their ESG strategies and programs, governance processes and structures, data collection systems, and they should consider how they will align their ESG reporting with their financial reporting. Sustrio ESG Advisors is a trusted advisor that helps organizations identify climate related-risks and opportunities to enhance corporate value through the energy transition. That means addressing changing regulatory regimes, investor demands, and stakeholder and Indigenous concerns. We do this by providing a full suite of sustainability/ESG services, Indigenous relations and engagement services, permitting and regulatory services, and legal services. Connect with us to see how we can help your company navigate the energy transition, optimize your ESG strategy and programming, and report on all your ESG matters. edit. |

AuthorWritten by Peter Forrester- Cofounder and Principal at Sustrio Archives

May 2023

|

Navigation |

The Company |

© COPYRIGHT 2023. ALL RIGHTS RESERVED.

|