|

Click here Get ready for the ISSB in 2023: Where sustainability reporting is going?

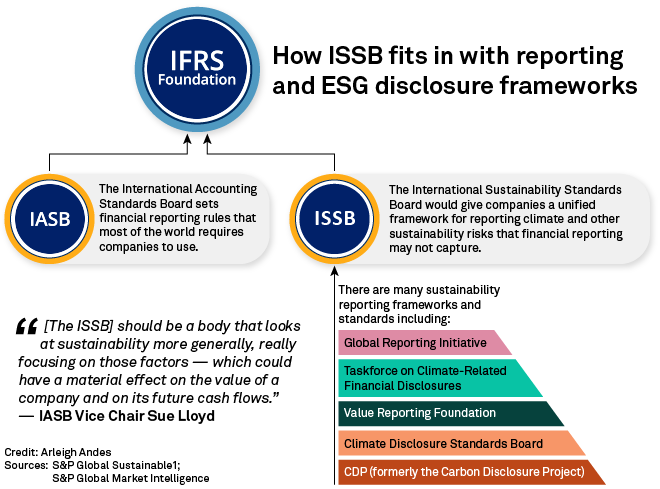

Peter Forrester December 6, 2022 Where are we are today on sustainability reporting? Canadian companies are in a global competition to attract capital and to grow market share. Increasingly, the ability to do so is dependent on how investors view a company’s performance on “non-financial factors” such as environmental, social, and governance (“ESG”) factors. Investors want to understand how performance in these areas impacts financial performance over the short-, medium- and long-term. Unfortunately, they are beholden to sustainability reporting, which is currently guided by a set of diverse, inconsistent, and often conflicting standards, frameworks, and ratings that do not offer comparability and consistency in sustainability reporting in general, and this has implications for financial performance in particular. But all of this is changing. Where in the world are we going? In short, international sustainability reporting standards tied to financial reporting are on the way. In November of 2021, the International Financial Reporting Standards (“IFRS”) Foundation, which is responsible for setting global financial reporting standards, created the International Sustainability Standards Board (“ISSB”). The ISSB was created in response to demands from the G20 countries and investors for the creation of global sustainability reporting standards that are tied to financial reporting, and can be relied upon as being comparable, credible, and consistent. Most importantly, the standards are such that investors and capital market participants can make capital allocation decisions based on how a company is addressing climate and energy transition risks and opportunities. To streamline things even more, shortly after the creation of the ISSB, the IFRS Foundation Trustees announced the planned consolidation of the IFRS Foundation, the Climate Disclosure Standards Board (“CDSB”), and the Value Reporting Foundation (“VRF,” formerly, the Sustainability Accounting Standards Board). The CDSB consolidation was completed in January 2022; the VRF consolidation in August 2022. In addition, in March 2022 ISSB and the Global Reporting Initiative (“GRI”) announced an MOU, committing both organizations to coordinate work programmes and standard-setting activities. The ISSB also released two draft sustainability standards this year, which went out for public consultation, and will likely be finalized in 2023. The first draft standard is the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information. S1 sets out the standard on what sustainability-related financial information about an entity’s significant sustainability-related risks and opportunities should disclose using the four thematic areas established by the Task Force on Climate-related Financial Disclosures (“TCFD”) framework. Essentially, it requires disclosures around TCFD’s four pillars of governance, strategy, risk management, and metrics and targets. Importantly, there are clear standards and guidance on concepts of what is material, enterprise value, disclosures related to dependencies on people and planet, and the requirement that such disclosures be made at the same time as a company’s general financial reporting. The second draft standard is the IFRS S2 Climate-related Disclosures. S2 builds on the TCFD recommendations and sets the requirements to be used in reporting on the identification, measurement, and disclosing of climate-related risks and opportunities. As with S1, it is also aligned with TCFD, including its call for the use of climate-related scenarios in risk planning and reporting. Given the wide adoption of IFRS standards and given that the standards are agnostic as to what accounting system a country uses (e.g., the U.S. uses Generally Accepted Accounting Standards (“GAAP”), not IFRS), it can be expected that countries around the world will move quickly to adopt the ISSB standards. How will Canada get there? In Canada, Financial Reporting Assurance Standards (“FRAS”) is tasked with setting and maintaining accounting and auditing standards in the public interest. In alignment with ISSB, FRAS announced the formation of the Canadian Sustainability Standards Board (“CSSB”). The CSSB, which will be fully functional by April 2023, is tasked with working with the ISSB to ensure Canadian views on sustainability standards are part of the ISSB’s work, as well as reviewing, endorsing, and implementing ISSB standards in Canada. In short, Canadian companies can expect that sustainability disclosures standards aligned with ISSB and CSSB are coming soon. This means more rigorous disclosures will be required and additional work will have to be done to translate how ESG factors will impact a corporation’s corporate value and financial outlook going forward. How to get ready for 2023 Many Canadian companies have identified their organizations’ ESG risks and opportunities and have started to develop baseline emissions inventories and strategies for how to address transition and physical climate-related risks and opportunities. But many are still behind in their ESG maturity and need to catch up quickly. To prepare for 2023 and the coming ISSB and CSSB standards, companies (particularly publicly-traded companies) should review the ISSB draft documents now. They should consider doing a gap analysis of where their sustainability reporting is today, and where it will need to be under the new standards. In particular, they should focus their efforts on long lead time items (things that cannot be implemented overnight) such as their ESG strategies and programs, governance processes and structures, data collection systems, and they should consider how they will align their ESG reporting with their financial reporting. Sustrio ESG Advisors is a trusted advisor that helps organizations identify climate related-risks and opportunities to enhance corporate value through the energy transition. That means addressing changing regulatory regimes, investor demands, and stakeholder and Indigenous concerns. We do this by providing a full suite of sustainability/ESG services, Indigenous relations and engagement services, permitting and regulatory services, and legal services. Connect with us to see how we can help your company navigate the energy transition, optimize your ESG strategy and programming, and report on all your ESG matters. edit.

0 Comments

Leave a Reply. |

AuthorWritten by Peter Forrester- Cofounder and Principal at Sustrio Archives

May 2023

|

Navigation |

The Company |

© COPYRIGHT 2023. ALL RIGHTS RESERVED.

|