|

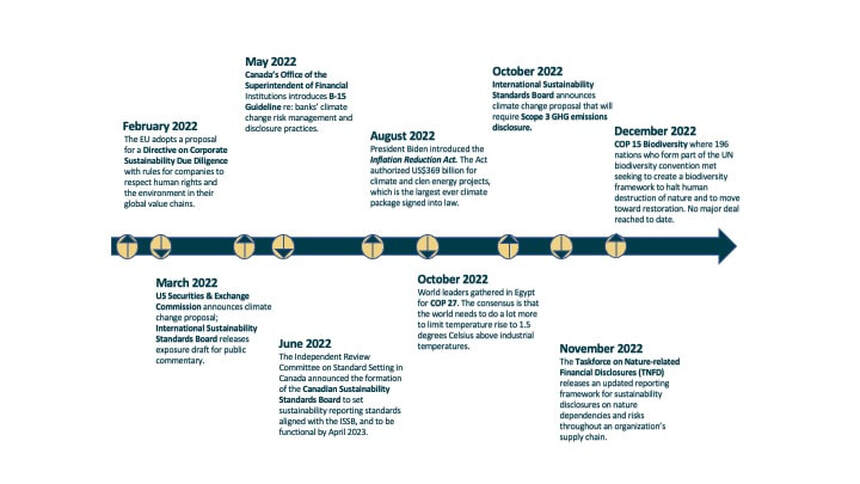

ESG in 2022 and 2023: Where are we and where can we expect to go? Peter Forrester December 20, 2022 You can’t know where you’re going unless you know where you’re at The world of sustainability and environmental, social, and governance (“ESG”) was jammed-packed in 2022 and looks to be even more crowded in 2023. So given it is the time of the year for yearly reviews and looks ahead, here’s our take on 2022’s major developments and 2023’s major expectations. Well, that was a busy year They say a picture is worth a thousand words. OK: Are we seeing some major themes here?

The first theme is we continue to move toward mandatory regulation of ESG and climate-related reporting and disclosure. In North America alone, the US Securities and Exchange Commission, Canadian Securities Administrators, Office of the Superintendent of Financial Institutions have all released draft disclosures. Keeping abreast of regulatory requirements will be critical for reporting in 2023. The second theme is a continued convergence of sustainability reporting frameworks aligned with investors’ needs. Most frameworks are aligning with the Task Force on Climate Related Financial Disclosures (“TCFD”). Not only are frameworks becoming more aligned with TCFD, but disclosure frameworks will increasingly demand climate risk reporting that is consistent, credible, comparable, and transparent and that demonstrates the impacts on long-term corporate value. The release of the International Sustainability Standards Board (“ISSB”) sustainability disclosure draft this year means we can expect significant reporting changes as soon as 2023. The third major theme is increasing the clampdown by regulators on “greenwashing.” We have seen regulators investigating and fining companies for making misleading of false claims regarding their sustainability performance or attributes of their products and services. Perhaps the most recent example in Canada is the investigation launched by the Canadian Competition Bureau last month against the Canadian Gas Association. In that case, the complainants allege that claims that natural gas is a low-emissions source of energy equate to deceptive marketing practices. We are also seeing increasing related litigation worldwide, which will continue to be a theme in 2023. The fourth theme is an increasing attention to the consideration of nature and biodiversity in addressing climate change risks and opportunities. This was a consistent theme at both COP 27 and COP 15 in the context of the economy being heavily dependent on the assets and services that nature provides. Yet, even as climate change risks point to the reliance on nature and the resilience of businesses and their supply chains, the translation of this relationship into risks to long-term corporate value are under-considered (or simply not considered) in sustainability reporting. This is changing as we can see from the development of the Taskforce on Nature Related Financial Disclosures (“TNFD”), which released a new risk management and disclosure framework in November this year. Additionally, this month the Global Reporting Initiative (“GRI”) announced a new draft biodiversity reporting standard in an attempt to bring about global standardized reporting in this area. These developments will have a significant impact on sustainability reporting in 2023. How will this impact your business in 2023? Investors, regulators, consumer, employees and stakeholder demands for understanding how businesses are addressing the risks posed by climate change will continue to grow. This demand is increasingly being taking shape in converging regulations and frameworks that can translate non-financial ESG factors into financial outcomes to provide insight into how business will fare through the inevitable climate change impacts that are already upon us. Successful companies have always considered their business risks and opportunities and translated these into strategies to mitigate the risks and maximize the opportunities. Companies in high-emitting and resource-intensive industries have been required to continue to develop their sustainability strategies, assessments, and reporting. Additional requirements, such as impending Scope 3 reporting, will continue to provide reporting challenges and opportunities. But additionally, sustainability reporting will become increasingly important to all companies, public or private, small or large, as the momentum and appetite to understand a broad range of ESG factors increases. The best thing you can do in 2023 is determine where you are on the sustainability reporting spectrum. Those companies that haven’t started the journey are well advised to do a basic sustainability materiality assessment of their businesses. Those companies that are well on their way, can benefit from increased proactive considerations of the themes above. And the leaders will continue to inform consolidating regulations and frameworks, science-based targets, a better understanding of their supply chains and Scope 3 emissions, and sustainability reports that are fully integrated into their public disclosures. 2023 looks to be a busy year on the sustainability front. Until then, best wishes for the holiday season and we look forward to chatting in 2023! Sustrio ESG Advisors is a trusted advisor that helps organizations identify climate related-risks and opportunities to enhance corporate value through the energy transition. That means addressing changing regulatory regimes, investor demands, and stakeholder and Indigenous concerns. We do this by providing a full suite of sustainability/ESG services, Indigenous relations and engagement services, permitting and regulatory services, and legal services. Connect with us to see how we can help your company navigate the energy transition, optimize your ESG strategy and programming, and report on all your ESG matters.

0 Comments

Leave a Reply. |

AuthorWritten by Peter Forrester- Cofounder and Principal at Sustrio Archives

May 2023

|

Navigation |

The Company |

© COPYRIGHT 2023. ALL RIGHTS RESERVED.

|