|

Has fine dining become unsustainable?

Karim Zariffa May 31, 2023 Navigating how to integrate sustainability and organizational purpose in any industry is a challenging task, even during the best of times. Striking the right balance between organizational risks, impacts, and opportunities while also addressing material sustainability topics can be complex and may sometimes lead to unintended consequences. This holds true even for renowned establishments like Noma restaurant, which provides an interesting case study regarding the sustainability of fine dining. Noma, founded 20 years ago by visionary chef Rene Redzepi and co-founder Claus Meyer in Copenhagen, Denmark, revolutionized the fine dining experience. With its avant-garde menu featuring unique dishes like chocolate-covered moss and reindeer brain custard, coupled with an emphasis on locally sourced and foraged ingredients The Noma fine dining experience became synonymous with sustainability. Chef Rene himself stated that sustainable practices have guided their creativity, not just through ingredient sourcing and reducing their carbon footprint, but also by creating the best possible work environment for their employees[1]. Over the past two decades, Noma has earned multiple titles of the World's Best Restaurant, most recently in 2021, while maintaining its three Michelin Star status. It is no secret that the fine dining industry often presents challenging working conditions for its staff. Despite claiming to champion values like free-range animal sourcing, sustainability, ethically sourced ingredients, farm-to-table approach, and organic practices, many restaurants frequently neglect the welfare of their own employees, one of the critical operational pillars of the industry. Noma's relentless pursuit of culinary innovation and exceptional customer experiences, while upholding sustainability principles, fell short when it came to providing a safe, secure, and fairly compensated working environment for their employees. Reports detailed unfavourable conditions, such as year-round foraging in harsh weather, plucking duck feathers outside in freezing rain, inconsistent work schedules, unpaid interns, and excessive work hours exceeding 40 per week. Only in October 2021 did Noma announce that they would start paying their interns, despite relying heavily on unpaid labor to produce their food[2] – something now recognized as inconsistent with a sustainable business model, and reminiscent of modern slavery or forced labor. However, despite the accolades and its unwavering commitment to sustainability, Noma announced in January 2023 its transition to a new chapter, Noma 3.0, with the understanding that the previous model conflicted with their dedication to the human aspect of sustainability, particularly the well-being of their employees.[3] Noma recognized that they were not fully living up to their sustainability practices. Chef Rene deserves credit for acknowledging that Noma could not continue on its current path without compromising its purpose and commitment to sustainability. With the reinvention of Noma as Noma 3.0, the restaurant’s focus will shift to rectifying the unsustainable aspects of the business model. The brand aims to become a lasting organization dedicated to ground-breaking work in the culinary field, but also aims to redefine the foundations of a restaurant team as a place where individuals can learn, take risks, and grow. By recognizing their shortcomings and taking proactive measures, Noma demonstrates a commitment to aligning purpose and sustainability, ensuring that their practices encompass not only the food they serve but also the well-being and fair treatment of their employees. This journey of transformation showcases the importance of constantly reassessing and evolving business models to ensure that purpose and sustainability remain at the core of an organization's values. [1] Source: Michelin Guide, Noma (link) [2] Imogen West-Knights, “Fine dining faces its dark truths in Copenhagen,” Financial Times, June 1, 2022. (link) [3] Noma 3.0 website (link)

0 Comments

From compliance burden to risk management: changing perspective for the transportation of dangerous goods

Hans Luu and Amit Bhargava March 7, 2023 Dangerous goods are essential to our lives and lifestyles Modern life is enabled by the daily transportation of dangerous goods (“TDG”) across the economic value chain. Generally speaking, a dangerous good is any substance or product that can pose a significant risk to health, safety, property, or the environment, if not properly stored, transported or handled. These goods are ubiquitous, number in the thousands and may be explosive, flammable, toxic, infectious, corrosive, radiating, or oxidizing. Some of the commonly stored chemicals in a household such as bleach, cleaning supplies and even gasoline are classified as dangerous. Whether transported via road, rail, air, or water, dangerous goods are essential to the manufacture and delivery of products and services that our lives and lifestyles depend on. Across global logistics and supply chains, TDG movements number in the multi-millions annually, and each movement of a dangerous good carries with it the potential to endanger human lives and damage the environment if an incident were to occur during transport. Here in Alberta, many people are unaware of the daily movement of dangerous goods on our main roadways that pass through densely populated centres and key public infrastructure (see the Government of Alberta’s Dangerous Goods Regions map here). The risk is so severe that governments strictly regulate all modes and stages of TDG to minimize potential incidents and enforce compliance with applicable laws by manufacturers, shippers, carriers, receivers, and users. In Canada and the USA federal oversight of TDG lies with Transport Canada and Pipeline and Hazardous Materials Safety Administration, respectively, and they are typically supported by complementary provincial- and state-level regulations and agencies. Public safety drives TDG regulations TDG regulations were designed with public safety (people, property, and the environment) and security in mind, and have been in place for over 40 years. Regulators enforce compliance through comprehensive classification and identification of dangerous goods, education and training, inspections, incident reporting and investigations, and prosecution. Shippers, carriers, and receivers must ensure that they have in place the required policies, management systems, processes and procedures, qualified personnel, training programs, and tracking documents that will enable them to comply with TDG regulations and ensure that they can continually improve their TDG performance. When any element in this system fails, the results can be disastrous – the recent February train derailment and subsequent toxic chemical release in Ohio is an unfortunate recent example (link). On February 3, 2023 a train carrying vinyl chloride and other hazardous materials derailed, prompting the evacuation of East Palestine, Ohio as authorities feared an explosion. This incident followed a January 27 derailment in northern Louisiana, where the leak of 10,000 gallons of “acid-related products” prompted an evacuation within a half-mile radius. Then on February 14, a truck traveling near Tucson, Arizona spilled nitric acid when it crashed, forcing an evacuation and extended highway closure. These incidents have put a spotlight on the risks of TDG and refocused public concerns about dangerous goods being transported through our communities. Compliance is mandatory, however, risk management is critical too The sheer volume and frequency of dangerous goods transported daily using multiple modes of transportation, coupled with the many touchpoints involved in shipping and handling, often make the task of TDG compliance an onerous and time-consuming one for shippers, carriers, and receivers. Oftentimes, this need to comply with numerous TDG regulations can cause companies to view TDG as a paperwork exercise and lose sight of the rationale for why such regulations exist in the first place – public safety. When we look at TDG through a risk management lens and connect the dots between regulation, compliance, and performance, moving beyond the compliance mindset to a risk management mindset can unlock value and mitigate unintended events and consequences. Risk management is a critical core function of any organization that wants to achieve specific goals while reducing losses. If we generically define risk management as a process of identifying, assessing, and controlling risks to an organization’s ability to achieve its goals while controlling the probability or impact of undesirable events and maximizing the realization of opportunities, then the benefits of applying this process to TDG becomes clearer. Case study: TDG shipping documents One critical example of the benefit of viewing TDG with a risk-based perspective is in the management of shipping documents. Currently in Canada, Transport Canada requires that all shipments of dangerous goods must be accompanied by a shipping document that identifies the dangerous goods that are being imported or transported. The shipping document is typically prepared by the shipper and must be a paper copy for road, rail, and air transport (electronic copies are permitted for marine transport). Carriers must keep an up-to-date copy of the shipping document while the dangerous goods are in transit, and once the goods are delivered, the shipper, carrier, and receiver must all retain copies of the shipping document for at least two years. Based on our experience and Transport Canada statistics, a typical medium-sized company can generate between 20,000 and 100,000 TDG shipping documents per year (large companies can generate millions of documents per year). This means that in Canada roughly 30 million plus shipping documents are created annually (the North American total is approximately 350 million plus annually). Furthermore, in our estimation, industry currently spends around $20-$50 for tracking, reconciling, filing, and storage of each paper shipping document. This is a staggering amount of paperwork and cost by any measure. Setting aside the environmental impact, labor burden, and cost associated with the mountain of TDG paperwork, a majority of TDG shipping documents are handwritten, which creates issues around accuracy, completeness, legibility, and accessibility (especially in cases of multiple deliveries where each segment of the delivery requires its own shipping document, resulting in a stack of paperwork accompanying the shipment). Exacerbating this problem is the ever-present possibility of an incident occurring during transport – our rough calculation based on Transport Canada’s statistic of approximately 500 incidents per year in Canada (about half of which happen in Alberta) where emergency responders are involved, is a 17 in a million chance. Although the likelihood of an incident is relatively low, the consequences can be severe, even catastrophic – again, the East Palestine train derailment and toxic chemical release is a tragic example. An effective, feasible, and available solution to the risks of this paper-based shipping document approach is to digitalize the entire process. By eliminating hardcopy shipping documents and using real-time digital documents, many of the inherent risks of handwritten paper documents can be eliminated. Not only will the digital shipping documents be more accurate, complete, and legible, they will be instantly accessible to emergency responders, should an incident occur. No longer would a first responder have to arrive to an incident and search for paperwork that may or may not be available or even legible, but they would have access to accurate information using a mobile app on a phone, tablet, or laptop. This ensures that their safety and that of the community is not unnecessarily put at risk. In addition to enhancing safety, other benefits of going digital include improved communication, reduced costs (insurance, compliance, filing, printing, storage, etc.), improved analysis and auditability (for performance management, sustainability reporting, etc.), and continual improvement of performance. Notwithstanding the many benefits of transitioning to digital TDG shipping documents, most companies still stick to a paper-based approach, likely due as much to organizational inertia as to not taking a risk management approach to TDG. On the other hand, regulators see the value in digitalizing TDG shipping documents and are encouraging companies to transition away from paper. Transport Canada’s TDG Regulatory Sandbox In recognition of the need to address the risks and burden of the paperwork-intensive approach to TDG shipping documents, and as part of its risk-based oversight approach, Transport Canada piloted its Transportation of Dangerous Goods Regulatory Sandbox project between January 2020 and March 2022. The goal of the pilot project was to assess whether using electronic shipping documents could be a viable alternative to the mandated paper format for transporting dangerous goods in Canada via air, marine, rail, and road. Transport Canada worked with select companies to trial the use of electronic shipping documents, and also engaged the Canadian Association of Fire Chiefs since firefighters are often first responders to accidents involving dangerous goods. The results of the TDG Regulatory Sandbox project were illuminating, and the full report can be requested on Transport Canada’s website here. Some of the key learnings from the project are:

Using the project’s findings, Transport Canada has identified a number of next steps it will take, the most important being:

EnviroApps provides a cost-effective, efficient, and proven cloud-based digital solution that replaces paper forms, spreadsheets, manual data entry, and automates the reporting process to help organizations track transportation of dangerous goods and hazardous waste. EnviroApps was also the first digital solution provider to offer electronic TDG shipping documents for road transportation under Transport Canada's TDG Regulatory Sandbox Project – in fact 2 out of the 3 road transport companies that participated in the TDG Regulatory Sandbox project relied on EnviroApps to digitalize their shipping documents. As Transport Canda’s TDG Regulatory Sandbox project makes clear, TDG is inseparable from the operation of our economy and industries and maintaining our quality of life. However, there are aspects of TDG that need to be modernized to ensure that risks can be managed in an efficient and effective manner while reducing the costs and administrative burdens of outdated systems. EnviroApps provides an effective solution that can transform the tracking of TDG shipping documents by lowering costs while reducing errors, enhancing safety, providing valuable business insights, and gathering valuable sustainability data effortlessly. Some additional benefits include:

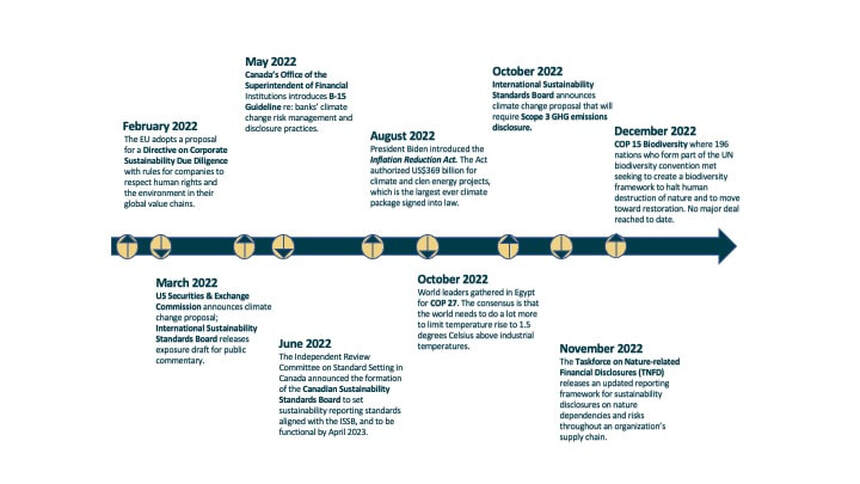

Conclusion Transport Canda’s TDG Regulatory Sandbox project highlighted a valuable opportunity for modernizing TDG regulations and processes. Although there remain some issues with switching to electronic shipping documents, these are primarily related to connectivity challenges, implementation costs, and organizational inertia – none of which are insurmountable. It is crystal clear that the advantages of digitalizing TDG far outweigh the challenges. There is very little benefit in continuing to rely on old processes and ways of doing things simply because it is how things have always been done or because of apprehensions around change, especially when the safety of first responders and communities, as well as the environment, are at risk when things go wrong. The TDG world is ripe for change and the digital transformation is coming – are you ready? Connect with us to learn how digitalizing your TDG documentation can help you manage your risks, reduce costs, and improve your TDG performance. Sustrio Advisors is a trusted advisor that helps organizations design and deliver on their enterprise sustainability/ESG, climate change and energy transition, Indigenous relations, and regulatory compliance goals and objectives, thus enhancing their long-term value. That means addressing changing regulatory regimes, investor demands, and stakeholder and Indigenous concerns by providing a full suite of sustainability/ESG services, Indigenous relations and engagement services, permitting and regulatory services, and legal services. Our partnership with EnviroApps also provides an innovative digital solution to replace manual tracking of transportation of dangerous goods and waste. Connect with us to see how we can help your company navigate the energy transition, optimize your sustainability/ESG strategy and programming, report your sustainability/ESG performance, and track your dangerous goods and waste. ESG in 2022 and 2023: Where are we and where can we expect to go? Peter Forrester December 20, 2022 You can’t know where you’re going unless you know where you’re at The world of sustainability and environmental, social, and governance (“ESG”) was jammed-packed in 2022 and looks to be even more crowded in 2023. So given it is the time of the year for yearly reviews and looks ahead, here’s our take on 2022’s major developments and 2023’s major expectations. Well, that was a busy year They say a picture is worth a thousand words. OK: Are we seeing some major themes here?

The first theme is we continue to move toward mandatory regulation of ESG and climate-related reporting and disclosure. In North America alone, the US Securities and Exchange Commission, Canadian Securities Administrators, Office of the Superintendent of Financial Institutions have all released draft disclosures. Keeping abreast of regulatory requirements will be critical for reporting in 2023. The second theme is a continued convergence of sustainability reporting frameworks aligned with investors’ needs. Most frameworks are aligning with the Task Force on Climate Related Financial Disclosures (“TCFD”). Not only are frameworks becoming more aligned with TCFD, but disclosure frameworks will increasingly demand climate risk reporting that is consistent, credible, comparable, and transparent and that demonstrates the impacts on long-term corporate value. The release of the International Sustainability Standards Board (“ISSB”) sustainability disclosure draft this year means we can expect significant reporting changes as soon as 2023. The third major theme is increasing the clampdown by regulators on “greenwashing.” We have seen regulators investigating and fining companies for making misleading of false claims regarding their sustainability performance or attributes of their products and services. Perhaps the most recent example in Canada is the investigation launched by the Canadian Competition Bureau last month against the Canadian Gas Association. In that case, the complainants allege that claims that natural gas is a low-emissions source of energy equate to deceptive marketing practices. We are also seeing increasing related litigation worldwide, which will continue to be a theme in 2023. The fourth theme is an increasing attention to the consideration of nature and biodiversity in addressing climate change risks and opportunities. This was a consistent theme at both COP 27 and COP 15 in the context of the economy being heavily dependent on the assets and services that nature provides. Yet, even as climate change risks point to the reliance on nature and the resilience of businesses and their supply chains, the translation of this relationship into risks to long-term corporate value are under-considered (or simply not considered) in sustainability reporting. This is changing as we can see from the development of the Taskforce on Nature Related Financial Disclosures (“TNFD”), which released a new risk management and disclosure framework in November this year. Additionally, this month the Global Reporting Initiative (“GRI”) announced a new draft biodiversity reporting standard in an attempt to bring about global standardized reporting in this area. These developments will have a significant impact on sustainability reporting in 2023. How will this impact your business in 2023? Investors, regulators, consumer, employees and stakeholder demands for understanding how businesses are addressing the risks posed by climate change will continue to grow. This demand is increasingly being taking shape in converging regulations and frameworks that can translate non-financial ESG factors into financial outcomes to provide insight into how business will fare through the inevitable climate change impacts that are already upon us. Successful companies have always considered their business risks and opportunities and translated these into strategies to mitigate the risks and maximize the opportunities. Companies in high-emitting and resource-intensive industries have been required to continue to develop their sustainability strategies, assessments, and reporting. Additional requirements, such as impending Scope 3 reporting, will continue to provide reporting challenges and opportunities. But additionally, sustainability reporting will become increasingly important to all companies, public or private, small or large, as the momentum and appetite to understand a broad range of ESG factors increases. The best thing you can do in 2023 is determine where you are on the sustainability reporting spectrum. Those companies that haven’t started the journey are well advised to do a basic sustainability materiality assessment of their businesses. Those companies that are well on their way, can benefit from increased proactive considerations of the themes above. And the leaders will continue to inform consolidating regulations and frameworks, science-based targets, a better understanding of their supply chains and Scope 3 emissions, and sustainability reports that are fully integrated into their public disclosures. 2023 looks to be a busy year on the sustainability front. Until then, best wishes for the holiday season and we look forward to chatting in 2023! Sustrio ESG Advisors is a trusted advisor that helps organizations identify climate related-risks and opportunities to enhance corporate value through the energy transition. That means addressing changing regulatory regimes, investor demands, and stakeholder and Indigenous concerns. We do this by providing a full suite of sustainability/ESG services, Indigenous relations and engagement services, permitting and regulatory services, and legal services. Connect with us to see how we can help your company navigate the energy transition, optimize your ESG strategy and programming, and report on all your ESG matters. The Sustainability-Indigenous Nexus: does your sustainability strategy consider it?

Peter Forrester December 13, 2022 Introduction Sustainability is, and will continue to be, viewed increasingly through an investor’s quantitative lens. Increasingly, businesses are being required to measure and disclose their sustainability performance. They are required to show, through data that are complete, credible, consistent, and comparable, that they are analyzing and improving the environmental, social, and governance elements of their business. Specifically, they must demonstrate that they have addressed the risks of climate change, including both physical risks to their assets and energy transition risks as we move to a lower carbon economy. Sometimes, however, Indigenous issues can be overlooked or lost in the noise and clamor of sustainability discussions and reporting. What do sustainability and environmental, social, and governance (“ESG”) metrics have to do with Indigenous issues? In short, “a lot.” The environment we share Canada is arguably endowed with a unique competitive advantage when it comes to the environment – we are gifted with vast tracts of undeveloped land ripe with oil, gas, forests, minerals, metals, biodiversity, and agriculture, with pristine lakes, rivers, and oceans, not to mention great feedstock for renewables, including solar, wind, hydro, and nuclear. When it comes to the land, water, and air and the resources they contain, we share them as non-Indigenous and Indigenous people alike. Indigenous peoples have been living on and from the land for thousands of years, hunting, trapping, fishing, and harvesting. They are keenly aware of the effects climate change brings to the environment as it impacts their ability to continue their traditional ways of life. They are equally aware of the energy transition, and how energy development impacts their traditional ways of life and well-being. Indigenous communities maintain their own Indigenous Knowledge, which they pass down from generation to generation. At the heart of that knowledge is a worldview that the universe, its people, and the environment are interconnected. Sustainability is viewed from a reciprocity concept between people and the planet. Indigenous peoples have a deep respect for nature and its conservation as well as a community-based management approach to lands and natural resources: “Traditional Knowledge has today become a highly valued source of information for archaeologists, ecologists, biologists, ethnobotanists, climatologists and others. This information ranges from medicinal properties of plants and insights into the value of biological diversity to caribou migration patterns and the effects of intentional burning of the landscape to manage particular resources. For example, some climatology studies have incorporated Qaujimajatuqangit (Inuit traditional knowledge) to explain changes in sea ice conditions observed over many generations.” (George Nicholas, “How Western science is finally catching up to Indigenous knowledge,” Macleans, February 15, 2018, link). This Indigenous knowledge is increasingly being combined with Western science in both understanding and addressing climate change as well as in project development. A recent example of Indigenous-led initiatives to address climate change Last week, the 15th Conference of the Parties (“COP 15”) to the United Nations Convention of Biological Diversity kicked off in Montreal. The meeting focuses countries’ attention on protecting the environment and halting biodiversity loss caused by climate change. Given that lands inhabited by Indigenous peoples contain 80% of the world’s remaining biodiversity, their inclusion is critical, according to the International Institute for Sustainable Development (link). This is even more apparent when we consider that Canada is warming twice as fast as the rest of the planet, and three times as fast in its most northern regions where many Indigenous people reside and depend on the land and water for their livelihood (see Isabella O’Malley, “Canada is warming twice as fast as the rest of the world,” The Weather Network, 2019, link). As the conference kicked off, the Liberal government highlighted the “Sustainability-Indigenous Nexus by announcing that it will spend up to $800 million to support four major Indigenous-led conservation projects covering nearly one million square kilometers across the country. The projects include:

These projects were announced during the kick off last week of the COP 15 UN Biodiversity Conference being held in Montreal. Resource project development In Canada, if project development impacts the rights, title, interests, and rights of Indigenous communities, the Crown (federal and provincial governments) have a legal obligation to consult, and if necessary, accommodate Indigenous communities for impacts. From a resource project development perspective, this “Crown consultation and engagement” has largely been addressed through the formal mechanisms of multiple energy and resource regulators. While that continues to occur, we are also seeing more proactive and creative ways for Indigenous communities’ involvement in such projects. A recent example is the landmark Enbridge Indigenous partnership in the Athabasca region of Alberta. In that deal, 23 Indigenous communities via the Athabasca Indigenous Investments entity acquired an 11.57 percent interest in seven Enbridge-operated pipelines. The investment is valued at $1.12 billion. Such investment allows Indigenous communities to have direct input into how resource projects are developed, operated, and expanded. They also have the added benefit of providing economic and social benefits to the communities involved. There are, and will continue to be, many more such joint resource projects. From an investor’s perspective, these joint projects have multiple benefits. Firstly, they de-risk projects by ensuring that the Indigenous environmental and other concerns are considered at the outset of the project, thus reducing execution risk. Secondly, they provide a source of opportunities available to benefit from sustainable resource projects and to build and enhance long-term corporate value for project developers. Social impact and Indigenous reconciliation In 2015, the Truth and Reconciliation Commissions’ final report set out a call to action for Canadian businesses. The report called on the corporate sector to apply a reconciliation framework to its corporate policies and operational activities involving Indigenous peoples, lands, and resources. It made 92 recommendations, with three concepts at the heart of those recommendations:

Businesses have a great opportunity to work with Indigenous communities on and around their operations to incorporate Indigenous knowledge into environmental approaches, as well as improving engagement in relation to the “S” in ESG. However, as reported in PwC’s … “Fewer than one in five (19%) of the companies on our analysis discloses a reconciliation action plan.” Those companies, particularly in the extractive industries can utilize their materiality assessments and sustainability reporting to demonstrate they are doing more on the reconciliation front. Conclusion Sustainability in Canada is intricately linked with Indigenous consultation and engagement. Tackling climate change and the transition to a low carbon economy present monumental risks and opportunities for Canadian businesses. Those risks are diminished, and the opportunities maximized, when non-Indigenous and Indigenous people work together toward a common goal. Indigenous peoples describe that goal broadly as “if we take care of the land, it will take care of us.” Investors might describe that goal as transparent, credible, consistent, comparable quantitative metrics illustrating improved ESG performance that will allow businesses to be sustainable in the long run. Regardless of what you call it, the result of working together for a more prosperous sustainable Canadian economy that maximizes the benefits and reduces the risks for all only occurs if we understand and respect the Sustainability-Indigenous Nexus. Sustrio ESG Advisors is a trusted advisor that helps organizations identify climate related-risks and opportunities to enhance corporate value through the energy transition. That means addressing changing regulatory regimes, investor demands, and stakeholder and Indigenous concerns. We do this by providing a full suite of sustainability/ESG services, Indigenous relations and engagement services, permitting and regulatory services, and legal services. Connect with us to see how we can help your company navigate the energy transition, optimize your ESG strategy and programming, and report on all your ESG matters. Click here Get ready for the ISSB in 2023: Where sustainability reporting is going?

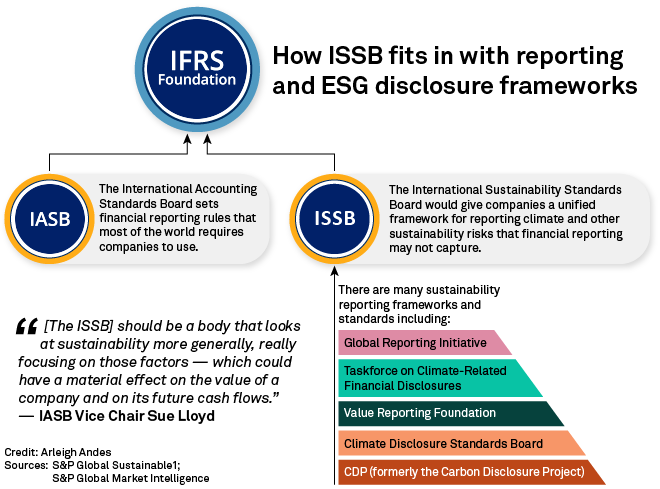

Peter Forrester December 6, 2022 Where are we are today on sustainability reporting? Canadian companies are in a global competition to attract capital and to grow market share. Increasingly, the ability to do so is dependent on how investors view a company’s performance on “non-financial factors” such as environmental, social, and governance (“ESG”) factors. Investors want to understand how performance in these areas impacts financial performance over the short-, medium- and long-term. Unfortunately, they are beholden to sustainability reporting, which is currently guided by a set of diverse, inconsistent, and often conflicting standards, frameworks, and ratings that do not offer comparability and consistency in sustainability reporting in general, and this has implications for financial performance in particular. But all of this is changing. Where in the world are we going? In short, international sustainability reporting standards tied to financial reporting are on the way. In November of 2021, the International Financial Reporting Standards (“IFRS”) Foundation, which is responsible for setting global financial reporting standards, created the International Sustainability Standards Board (“ISSB”). The ISSB was created in response to demands from the G20 countries and investors for the creation of global sustainability reporting standards that are tied to financial reporting, and can be relied upon as being comparable, credible, and consistent. Most importantly, the standards are such that investors and capital market participants can make capital allocation decisions based on how a company is addressing climate and energy transition risks and opportunities. To streamline things even more, shortly after the creation of the ISSB, the IFRS Foundation Trustees announced the planned consolidation of the IFRS Foundation, the Climate Disclosure Standards Board (“CDSB”), and the Value Reporting Foundation (“VRF,” formerly, the Sustainability Accounting Standards Board). The CDSB consolidation was completed in January 2022; the VRF consolidation in August 2022. In addition, in March 2022 ISSB and the Global Reporting Initiative (“GRI”) announced an MOU, committing both organizations to coordinate work programmes and standard-setting activities. The ISSB also released two draft sustainability standards this year, which went out for public consultation, and will likely be finalized in 2023. The first draft standard is the IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information. S1 sets out the standard on what sustainability-related financial information about an entity’s significant sustainability-related risks and opportunities should disclose using the four thematic areas established by the Task Force on Climate-related Financial Disclosures (“TCFD”) framework. Essentially, it requires disclosures around TCFD’s four pillars of governance, strategy, risk management, and metrics and targets. Importantly, there are clear standards and guidance on concepts of what is material, enterprise value, disclosures related to dependencies on people and planet, and the requirement that such disclosures be made at the same time as a company’s general financial reporting. The second draft standard is the IFRS S2 Climate-related Disclosures. S2 builds on the TCFD recommendations and sets the requirements to be used in reporting on the identification, measurement, and disclosing of climate-related risks and opportunities. As with S1, it is also aligned with TCFD, including its call for the use of climate-related scenarios in risk planning and reporting. Given the wide adoption of IFRS standards and given that the standards are agnostic as to what accounting system a country uses (e.g., the U.S. uses Generally Accepted Accounting Standards (“GAAP”), not IFRS), it can be expected that countries around the world will move quickly to adopt the ISSB standards. How will Canada get there? In Canada, Financial Reporting Assurance Standards (“FRAS”) is tasked with setting and maintaining accounting and auditing standards in the public interest. In alignment with ISSB, FRAS announced the formation of the Canadian Sustainability Standards Board (“CSSB”). The CSSB, which will be fully functional by April 2023, is tasked with working with the ISSB to ensure Canadian views on sustainability standards are part of the ISSB’s work, as well as reviewing, endorsing, and implementing ISSB standards in Canada. In short, Canadian companies can expect that sustainability disclosures standards aligned with ISSB and CSSB are coming soon. This means more rigorous disclosures will be required and additional work will have to be done to translate how ESG factors will impact a corporation’s corporate value and financial outlook going forward. How to get ready for 2023 Many Canadian companies have identified their organizations’ ESG risks and opportunities and have started to develop baseline emissions inventories and strategies for how to address transition and physical climate-related risks and opportunities. But many are still behind in their ESG maturity and need to catch up quickly. To prepare for 2023 and the coming ISSB and CSSB standards, companies (particularly publicly-traded companies) should review the ISSB draft documents now. They should consider doing a gap analysis of where their sustainability reporting is today, and where it will need to be under the new standards. In particular, they should focus their efforts on long lead time items (things that cannot be implemented overnight) such as their ESG strategies and programs, governance processes and structures, data collection systems, and they should consider how they will align their ESG reporting with their financial reporting. Sustrio ESG Advisors is a trusted advisor that helps organizations identify climate related-risks and opportunities to enhance corporate value through the energy transition. That means addressing changing regulatory regimes, investor demands, and stakeholder and Indigenous concerns. We do this by providing a full suite of sustainability/ESG services, Indigenous relations and engagement services, permitting and regulatory services, and legal services. Connect with us to see how we can help your company navigate the energy transition, optimize your ESG strategy and programming, and report on all your ESG matters. edit. Regulatars are circling on climate change and ESG: are you ready? Peter Forrester November 29, 2022 Securities Regulators are developing standards for ESG disclosures while enforcing misleading disclosures Investors continue to ramp up pressure on businesses to disclose the risks they face related to climate change. It is increasingly important to investors that they understand how businesses are financially impacted in the long term by climate change risks. The companies that make disclosures substantiating their understanding of climate risks and opportunities signal that they are addressing them, and will ultimately continue to have access to investors’ capital. There are, however, two major challenges facing both investors and businesses related to the disclosure of climate risks. Firstly, disclosure standards are largely voluntary and based on developing frameworks, none of which are definitive. Regulators are in the midst of developing mandatory standards, but largely they are not in place yet today. Investors want credible, comparable, complete, consistent and regulator reporting on climate risks, but to date the frameworks and regulations have yet to provide sufficient consensus guidance on these elements. Secondly, to meet the demand for goods and services from business that are addressing climate change risks, businesses are keen to flex their green muscles. They are disclosing what they have determined, based in part on the developing frameworks and regulations, to be the positive ESG benefits of their offerings. Herein lies the problem. Without definitive disclosure standards, companies are left to their own devices in describing their ESG performance. In particular, they can get themselves in trouble by marketing goods and services which they think have positive ESG benefits, when it just ain’t so. Where this marketing disclosure is relied upon by investors, regulators are increasingly investigating the accuracy of the positive assertions. As we see from last week’s enforcement action by the U.S. Securities and Exchange Commission (SEC) charging Goldman Sachs Asset Management L.P. (GSAM) for failing to implement and follow policies and procedures for funds marketed as Environmental, Social and Governance (ESG) investments, companies need to carefully evaluate their ESG-related disclosures. What are the current requirements to disclose climate-related risks? Currently, in both Canada and the United States, publicly listed companies are required to publicly disclose material facts and changes that can reasonably be expected to impact the value of the company’s stock (i.e., is material to investors). In essence, each company determines what climate-related risks, or ESG matters, it deems material and wishes to disclose. This disclosure has been augmented by reporting these risks through voluntary standards and frameworks like SASB, GRI, or TCFD. Despite these frameworks being voluntary, investors have increasingly been utilizing these frameworks to evaluate the risk and return of a particular company in its investment decisions. Proposed regulatory requirements In March of this year, the SEC introduced the “Issuer Rule,” which proposes that public companies provide certain climate-related financial data and information related to greenhouse gas (GHG) emissions in their public disclosure filings. The SEC followed up in May 2022 with the additional “Investor Rule” proposing to require investment funds claiming to be focused on ESG to disclose more details about what these ESG strategies are in their public filings, including prospectuses and annual reports. While not in force, the expectation is that the Investor Rule will be finalized by the end of 2022, and come into force in the following year or so. With the Issuer Rule, public companies in the U.S. will no longer have to make the materiality assessment as it relates to certain climate-related and ESG risks – disclosure will be required. Specifically, public companies will have to report climate-related risks totaling 1% or higher of a total line item in a relevant year’s financial statements. There will no doubt be further Canadian and global rules that will follow suit. We have already seen the Canadian Securities Administrators and the Office of the Superintendent of Financial Institutions introduce similar, albeit less stringent, proposals. What will attract ESG-related enforcement? The GSAM case is a good illustration of what will attract enforcement. GSAM marketed two mutual funds and a separately managed account based on certain ESG attributes. Initially, it did so without having sound governance (policies or procedures) in place relating to how it was conducting its research and selecting securities for inclusion into these investments. When it did put the policies and procedures in place, it at times failed to follow its own policies and procedures. The representative for the SEC, Deputy Director of the SEC’s Division of Enforcement and head of its Climate and ESG Task Force gave a good summary of what is required to avoid enforcement: “In response to investor demand, advisors like Goldman Sachs Asset Management are increasingly branding and marketing their funds and strategies as ‘ESG.’ When they do, they must establish reasonable policies and procedures governing how the ESG factors will be evaluated as part of the investment process, and then follow those policies and procedures, to avoid providing investors with information about these products that differs from their practices.” SEC press release, “SEC Charges Goldman Sachs Asset Management for Failing to Follow its Policies and Procedures Involving ESG Investments” (November 22, 2022, link). Companies can have good intentions when they describe the beneficial ESG attributes of their offerings, but they must ensure that their descriptions are accurate and true. Not following your own internal policies will only be evidence that the disclosures are not true, and such conduct will be a ready-made formula for enforcement. Expectations going forward We continue to see the call for increased regulations related to climate and ESG disclosures becoming mandatory. For example, at the recently wrapped-up COP 27, we saw the United Nations’ High-Level Expert Group recommend further mandatory reporting requirements. And just last week we saw the Financial Conduct Authority, the UK financial services and financial markets regulator, announce the formation of a working group to develop a code of conduct for ESG data and rating providers. This was a partial response to the November 2021 call from securities regulator standards-setter IOSCO, which urged more regulatory oversight in the ESG space. It is not a matter of whether mandatory regulation and increased enforcement are coming, but how quickly they will come. To prepare for the regulations, and to avoid enforcement action, companies need to improve their internal processes for carefully analyzing their climate risks, converting these into financial outcomes, reporting performance in a transparent, credible and consistent way, and managing progress of their climate-related risk mitigation strategies. Failure to prepare will threaten access to capital on the front end, and potential greenwashing enforcement on the back end. Sustrio ESG Advisors helps educate businesses on ESG and climate-related reporting, understand the international reporting regimes, perform scenario analysis, and produce quality, data-driven disclosures relevant to investment and financial markets. Sustrio’s legal advisory services also review company disclosures to avoid material misrepresentations. Connect with us to see how we can help your company navigate the energy transition and report on all your ESG matters. My emissions are less than your emissions |

AuthorWritten by Peter Forrester- Cofounder and Principal at Sustrio Archives

May 2023

|

Navigation |

The Company |

© COPYRIGHT 2023. ALL RIGHTS RESERVED.

|